The non-partisan issue of College Station ISD’s $351 million dollar bond issue has drawn the opposition of the Brazos County Republican Party’s executive committee.

WTAW News requested and received a reply from CSISD to the resolution.

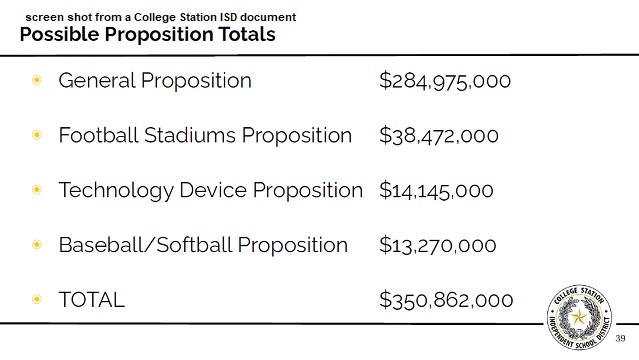

WHEREAS the College Station Independent School District has approved an order calling for a bond election for November 7, 2023, for $350,865,000 for four projects, including Propositions A, B, C, and D, and

WHEREAS the taxpayers in the CSISD are facing a Brazos County tax rate increase, combined with rising assessments increasing property values, which will raise taxes owed by the taxpayers to their detriment because the taxpayers of CSISD are suffering from accelerating increases in the price of food and gasoline and should not be further inflicted by increased taxes, and

WHEREAS despite taxes being too high for too long, CSISD has returned time after time to the voter to increase property taxes while passing deficit budgets and is now wishing to raise taxes on top of already excessive taxes, including the 37.7% of CSISD student families who are economically disadvantaged and having difficulty buying food and fuel, and

WHEREAS, although the Republican Party of Texas passed a legislative priority to abolish the oppressive property tax, resulting in the 2023 Texas Legislature providing a tiny bit of insufficient tax relief, the CSISD bond proposal eclipses that relief instead of letting people breathe, and

WHEREAS CSISD is not accurately representing to the public: first, a tax increase estimate of $20 a year on only a $100,000 taxable value while acknowledging elsewhere that the average taxable value of homes in the District is $319,993; secondly, employing an assumption that valuation in properties will decline, third value changes over the next ten years which representation is moot because of the legal language authorizing a tax “without limit as to rate or amount, “and third an assumption that valuation in properties will decline, and

THEREFORE, BE IT RESOLVED that the undersigned members of the Executive Committee of the Republican Party of Brazos County oppose the passage of College Station Independent School District’s bond proposals A, B, C, and D, and

BE IT FURTHER RESOLVED that the undersigned members of the Executive Committee of the Republican Party of Brazos County admonish the District for minimizing the impact of the bond to the taxpayer through disingenuous language distributed to the public in the Order and urges more transparency in future communications, and

BE IT FURTHER RESOLVED that should this resolution pass, the Chair of the Republican Party of Brazos County shall send the media and the members of the College Station City Council a press release with a copy of this resolution, stating the undersigned members of the Executive Committee’s opposition to the bond proposals.

Ginger Mikeska – Precinct Chair – Precinct 1

Donald Crow – Precinct Chair – Precinct 2

Bill Bingham – Precinct Chair – Precinct 9

Jerri Lynn Ward, J.D. – Precinct Chair – Precinct 24

Susan Lucas – Precinct Chair – Precinct 26

Ray Thomas – Precinct Chair – Precinct 29

Bill Boyd – Precinct Chair – Precinct 31

Shauna Cox – Precinct Chair – Precint 37

Ronnie Vitulli – Precinct Chair – Precinct 48

Silas Garrett Jr. – Precinct Chair – Precinct 61

Jeff Murski – Precinct Chair – Precinct 63

Mark Browning – Precinct Chair – Precinct 64

Ann Walton – Precinct Chair – Precinct 76

Elizabeth Varley – Precinct Chair – Precinct 77

College Station ISD statement to WTAW News regarding the resolution from the Brazos County Republican Party executive committee:

College Station ISD’s 2023 Bond proposal is a community-driven plan that includes district-wide safety and technology upgrades, additions and renovations to campuses and facilities, and increased opportunities for students to participate in Career and Technical Education (CTE).

The current total tax rate of 96.22 cents is now 43.58 cents lower than the 2017 rate of $1.3980, a decrease of 31 percent in the last six years. The projected tax increase with the passage of the Bond is approximately 2 cents, which will make CSISD taxes 19.5 cents lower than in 2022.

Even with the recent increases in property values, the lowered overall CSISD tax rate added, the decreases that have occurred since 2017, and the increase in the homestead exemption from $40,000 to $100,000 that is on the Nov. 7 ballot, many homeowners will be paying less in CSISD property taxes than they did in 2017. (Taxpayers should review their own property tax history.)

To learn more about the 2023 Bond, visit bond.csisd.org.