The Texas A&M Real Estate Center describes the College Station/Bryan area as having “explosive” price behavior of home sales.

The local market is one of the two metro areas out of 25 in the state reaching the highest level of activity between the second quarter of 2015 and second quarter of 2016.

Chief economist Jim Gaines says the demand for single family homes…barring an economic recession…is expected to continue for at least another couple of years.

Dr. Gaines also noted in August there was a drop in the local construction of multi-family housing.

Click below for comments from Jim Gaines, visiting with WTAW’s Chelsea Reber:

Click HERE to read and download the Texas A&M Real Estate Center report.

From the Texas A&M Real Estate Center:

Single-family home starts in Texas fell dramatically in August despite continued demand throughout most of the state, according to the latest Texas Housing Insight report by the Real Estate Center at Texas A&M University.

The report showed residential building permits for August were up statewide over the year and over the month, but housing starts were down 21.6 percent seasonally adjusted year-over-year.

Center Research Economist Dr. Luis Torres, who wrote the report with Chief Economist Dr. Jim Gaines and Research Associate Wayne Day, said low housing inventories and rising prices in many areas of the state signal a high demand for housing, but construction markets are being affected by a shortage of workers and developed lots.

“For this to change, there has to be either an increase in the number of residential construction workers or a slowdown in the demand for new housing,” Torres said. The numbers suggest demand isn’t showing signs of slowing, he noted.

Total Texas home sales for August increased 7.4 percent year-over-year seasonally adjusted (7.2 percent on a non-seasonally adjusted basis) compared with a positive 8.8 percent nationally (8.4 percent on a non-seasonally adjusted basis).

Austin (7.4 percent), Dallas-Fort Worth (5.2 percent), Houston (8.3 percent), and San Antonio (12.1 percent) all increased year-over-year. The metros gained on a monthly basis as well. On a year-to-date basis, Houston is ahead of last year by 1.1 percent while Dallas-Fort Worth is up by 4.8 percent (non-seasonally adjusted).

Average and median sales prices have risen dramatically in Texas since 2011, especially for new homes. During that time, according to the center’s housing report, new home prices have exceeded existing home prices by 48 percent and 37 percent based on median and average sales prices, respectively.

“This price differential is primarily a result of increases in home size for newer homes and the significant increases in construction and land costs for new homes,” Torres said.

The average price per square foot for a new home in Texas is about 19 percent more than for an existing home, according to the report.

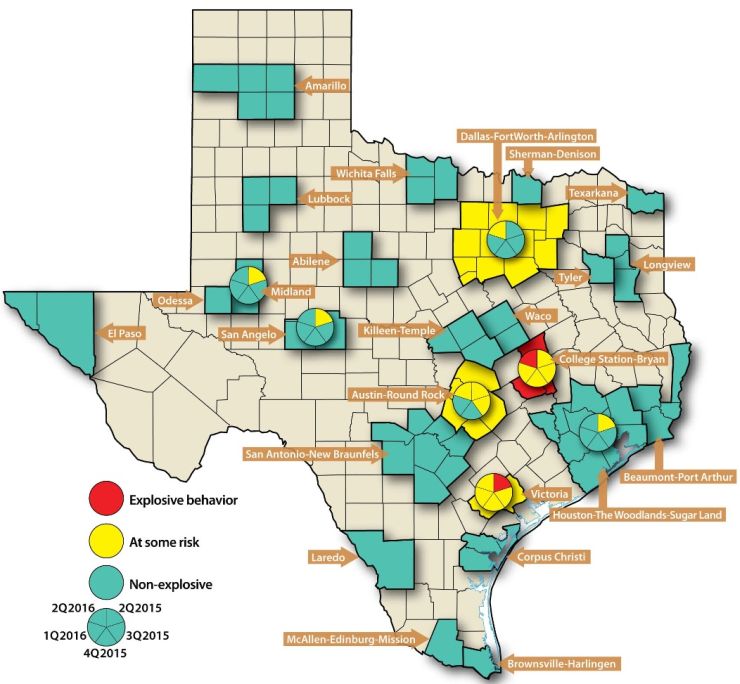

A new map from the center shows which of Texas’ 25 Metropolitan Statistical Areas (MSAs) are exhibiting “explosive” (or exuberant) behavior in home prices. Torres said such behavior can occur when high home prices are not based on housing market fundamentals such as demand and supply.

The map shows price behavior from second quarter 2015 through second quarter 2016, the College Station-Bryan MSA had a period of explosive behavior in 2Q2016, while the DFW (Dallas, in particular), Austin and Victoria MSAs posted some unusual price movements.

The complete report is available online at https://www.recenter.tamu.edu/articles/technical-report/Texas%20housing%20economy%20leading%20index%20construction.