The pandemic has taken a nearly $1 billion dollar hit on the Texas economy.

Monday’s revenue estimate from state comptroller Glenn Hegar is down four-tenths of one percent.

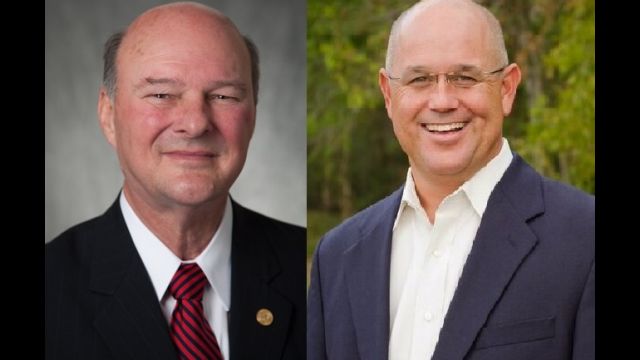

It’s not as bad as thought by Brazos County state representatives John Raney of Bryan and Kyle Kacal of College Station.

Click below for visits from John Raney and Kyle Kacal, both visiting with WTAW’s Bill Oliver.

News release from Texas comptroller Glenn Hegar:

Texas Comptroller Glenn Hegar released the Biennial Revenue Estimate (BRE) today, showing the state is projected to have $112.5 billion in revenue available for general-purpose spending during the 2022-23 biennium.

The revenue estimate represents a 0.4 percent decrease from funds available for the 2020-21 biennium. This decline is a direct result of the COVID-19 pandemic, which caused revenue collections to fall well short of what was expected when the Legislature approved the 2020-21 budget; the ending 2020-21 balance will be close to a negative $1 billion.

“As is always the case, this estimate is based on the most recent and precise information we have available,” Hegar said. “It represents our efforts to provide lawmakers with the most accurate forecast possible as they craft the budget for the 2022-23 biennium and the supplemental spending bill to address the remainder of the current biennium.

“The forecast, however, remains clouded with uncertainty. The ultimate path of the pandemic and the behavior of consumers and businesses during a resurgence are difficult to gauge. It’s also unclear how they’ll respond once the pandemic is fully under control. As a result, there is a wide range of possible outcomes for state revenue through the end of fiscal 2023, with the possibility of revenue falling short of this forecast but also a chance revenue could exceed it, perhaps substantially.

“In any case, the Legislature will again face some difficult choices to balance the budget. While savings from agency spending cuts and federal funding could help erase the projected shortfall for this biennium, a substantial supplemental appropriations bill could increase it, thereby reducing revenue available for the next biennium.”

The $112.5 billion available for general-purpose spending includes 2022-23 collections of $119.6 billion in General Revenue-Related (GR-R) funds. These collections will be offset by an expected 2020-21 ending GR-R balance of negative $946 million. In addition, $5.8 billion must be reserved from oil and natural gas taxes for 2022-23 transfers to the Economic Stabilization Fund (ESF) and the State Highway Fund (SHF); another $271 million must be set aside to cover a shortfall in the state’s original prepaid college tuition plan, the Texas Tomorrow Fund.

The projected shortfall does not account for any GR-R expenditure reductions resulting from the state leadership’s instructions for most state agencies to reduce spending by 5 percent of their 2020-21 GR-R appropriations. Nor does it incorporate the effects of substituting federal funds provided as pandemic-related assistance for some GR-R pandemic-related expenditures. Official action on either of those items could eliminate the projected shortfall, which must be made whole by the 87th Legislature.

Sales tax collections make up the state’s largest source (62 percent) of GR-R revenues in 2022-23. The BRE projects sales tax revenues will increase by 5.1 percent from the 2020-21 biennium, reaching $64.1 billion for the 2022-23 biennium after $5 billion is allocated to the SHF.

Other significant sources of GR-R revenues in 2022-23 include:

motor vehicle-related taxes, including sales, rental and manufactured housing taxes, which are expected to reach $10.1 billion, up 5.1 percent from 2020-21;

oil production tax collections, which are projected to generate $6.5 billion, up 10.1 percent from 2020-21;

natural gas tax collections, which are expected to raise $3.5 billion, up 66.9 percent from 2020-21; and

franchise tax collections, which are projected to generate $6.3 billion, up 5.1 percent from 2020-21; for all funds, franchise tax revenue is estimated to generate $9 billion, up 4.4 percent from 2020-21.

The ESF (the state’s “Rainy Day Fund”) currently contains about $10.5 billion, not counting currently outstanding spending authority. Absent any legislative appropriations, the ESF balance is expected to total $11.6 billion at the end of 2022-23.

State revenue from all sources and for all purposes is expected to reach $270.5 billion for the 2022-23 biennium, including about $98.2 billion in federal receipts, along with other income and revenues dedicated for specific purposes and therefore unavailable for general-purpose spending.

“We must keep an eye on several things that could impact this forecast, including the spread of the COVID-19 virus and the possibility of renewed reduction in customer-facing economic activity,” Hegar said.

“In addition, we must carefully monitor the nascent recovery in energy markets as further shocks on either the demand or supply side could threaten recent positive developments for prices and production.

“On the other hand, household savings have increased during the pandemic, while credit card debt has declined; this could support increased consumer spending once people feel safe to return to pre-pandemic activities. So, while there are numerous potential concerns, my economic forecast assumes a further moderate decline in economic activity in fiscal 2021, followed by a return to growth in the 2022-23 biennium at rates somewhat higher than those experienced during the last decade.”

The Biennial Revenue Estimate and visuals from today’s press conference are available on the Comptroller’s website.