One of three speakers during the public comment portion of the Bryan city council meeting on December 11 was opposed to banning the homeless in downtown Bryan from asking for assistance.

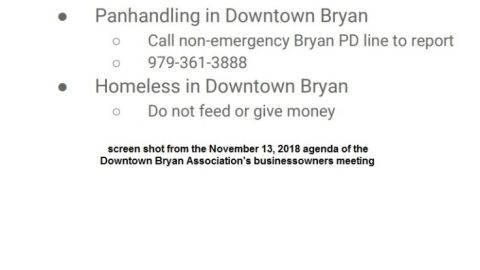

Lucas DeChemin, who works in downtown Bryan, referred to the agenda of the November 13 Downtown Bryan Association’s (DBA) businessowners meeting. DeChemin referred to a bullet point titled “Homeless in Downtown Bryan” stated “do not feed or give money”. The agenda also had a bullet point titled “Panhandling in Downtown Bryan”, with a statement to “Call non-emergency Bryan PD line to report”.

The DBA’s executive director, Sandy Farris, issued the following statement to WTAW News: “Balancing compassion for the homeless with an environment desired by our downtown businesses can be a challenge. We have a good relationship with Bryan PD and rely on their advice in this situation.”

Bryan police sergeant Ryan Bona says solicitation is regulated by two city ordinances and one state law.

One city ordinance that prohibits “aggressive solicitation” involves a person’s behavior and in some cases where the solicitation takes place.

The second city ordinance prohibits asking for money for goods and services unless the solicitor has a permit.

The state law bans pedestrians asking motorists or their passengers unless the solicitor is representing a charitable organization recognized by the IRS.

Click below for comments from Lucas DeChemin and Ryan Bona:

Sec. 82-11. – Aggressive solicitation prohibited. (provided by the Bryan police department)

(a) The council finds that:

(1) Aggressive solicitation is disturbing and disruptive to residents and businesses and contributes to the loss of access to and enjoyment of public places and to a sense of fear, intimidation and disorder.

(2) Aggressive solicitation includes approaching or following pedestrians, repetitive soliciting despite refusals, the use of abusive or profane language to cause fear and intimidation, unwanted physical contact, or the intentional blocking of pedestrian and vehicular traffic.

(3) The presence of individuals who solicit money from persons at or near banks, automated teller machines, check cashing businesses, public transportation stops and facilities, self serve car washes, self service fuel pumps, exterior public pay telephone and crosswalks is especially troublesome because of the enhanced fear of crime in a place that is confined, difficult to avoid, or where a person might find it necessary to wait.

(4) This section is intended to protect citizens from the fear and intimidation accompanying certain kinds of solicitation, and not to limit a constitutionally protected activity.

(b)Definitions.

(1) Aggressive manner means:

a. Intentionally or recklessly making any physical contact with or touching another person in the course of the solicitation without the person’s consent;

b. Following the person being solicited, if that conduct is:

(i) Intended to or likely to cause a reasonable person to fear imminent bodily harm or the commission of a criminal act upon property in the person’s possession; or

(ii) Intended to or reasonably likely to intimidate the person being solicited into responding affirmatively to the solicitation;

c. Continuing to solicit a person within five feet of the person being solicited after the person has made a negative response;

d. Intentionally or recklessly blocking the safe or free passage of the person being solicited or requiring the person, or the driver of a vehicle, to take evasive action to avoid physical contact with the person making the solicitation;

e. Using obscene or abusive language or gestures toward the person being solicited;

f. Approaching the person being solicited in a manner that:

(i) Is intended to or is likely to cause a reasonable person to fear imminent bodily harm or the commission of a criminal act upon property in the person’s possession; or

(ii) Is intended to or is reasonably likely to intimidate the person being solicited into responding affirmatively to the solicitation.

(2) Automated teller machine means a device, linked to a bank’s account records, which is able to carry out banking transactions.

(3) Automated teller facility means the area comprised of one or more automatic teller machines, and any adjacent space that is made available to banking customers.

(4) Bank includes a bank, savings bank, savings and loan association, credit union, trust company, or similar financial institution.

(5) Bus means a vehicle operated by a transit authority for public transportation.

(6) Check cashing business means a person in the business of cashing checks, drafts, or money orders for consideration.

(7) Exterior public pay telephone means any coin or credit card reader telephone that is:

a. Installed or located anywhere on a premises except exclusively in the interior of a building located on the premises; and

b. Accessible and available for use by members of the general public.

(8) Public area means an outdoor area to which the public has access and includes, but is not limited to, a sidewalk, street, highway, park, parking lot, alleyway, pedestrian way, or the common area of a school, hospital, apartment house, office building, transport facility, or shop.

(9) Public transportation facility means a facility or designated location that is owned, operated, or maintained by a city, transportation authority, public transportation benefit area, regional transit authority or metropolitan municipal corporation within the state.

(10) Public transportation stop means an area officially designated as a place to wait for a bus, or any other public transportation vehicle that is operated on a scheduled route with passengers paying fares on an individual basis.

(11) Self-service car wash means a structure:

a. At which a vehicle may be manually washed or vacuumed by its owner or operator with equipment that is activated by the deposit of money in a coin-operated machine, and

b. That is accessible and available for use by members of the general public.

(12) Self-service fuel pump means a fuel pump:

a. From which a vehicle may be manually filled with gasoline or other fuel directly by its owner or operator, with or without the aid of an employee or attendant of the premises at which the fuel pump is located; and

b. That is accessible and available for use by members of the general public.

(13) Solicit means to request, by the spoken, written, or printed word, or by other means of communication an immediate donation or transfer of money or another thing of value from another person, regardless of the solicitor’s purpose or intended use of the money or other thing of value, and regardless of whether consideration is offered.

(c) A person commits an offense if the person solicits:

(1) In an aggressive manner in a public area;

(2) In a bus, at a public transportation facility or public transportation stop, or at a facility operated by a transportation authority for passengers;

(3) Within 25 feet of:

a. An automated teller facility;

b. The entrance or exit of a bank;

c. The entrance or exit of a check cashing business;

d. A self service carwash or self service fuel pump;

(4) At a marked crosswalk.

(5) At a sidewalk café authorized under chapter 62-243 (Sidewalk Cafés) or the patio area of a bar or restaurant.

(d) A culpable mental state is not required, and need not be proven, for an offense under subsection (c)(2), (3), (4), or (5).

(e) During a permitted street closure event or a permitted city sponsored special event, it shall not be an offense under subsection (c)(3) and (4) for persons registered with the permittee to solicit in such locations when authorized and so defined in the approved street closure or special event permit.

(f) This section is not intended to proscribe a demand for payment for services rendered or goods delivered.

(g) A violation of this article shall be punishable by a fine not to exceed $500.00.

Chapter 90 – PEDDLERS AND SOLICITORS From https://library.municode.com/tx/bryan/codes/code_of_ordinances?nodeId=PTIICOOR_CH90PESO

ARTICLE I. – IN GENERAL Secs. 90-1—90-18. – Reserved.

ARTICLE II. – ITINERANT VENDORS

Sec. 90-19. – Definitions. As used in this article, the following words and terms shall have the meanings respectively ascribed as follows:

Auctions shall mean all sales made by bids received through an auctioneer. Exempt are estate sales conducted by a court-appointed administrator or independent executor, personally or through a licensed auctioneer.

Charitable funds shall mean any money, property, or anything of value, or the pledge of a future donation of money, property or anything of value; or the sale or offer for sale of any property, real or personal, tangible or intangible, whether of value or not, including, but not limited to, goods, books, pamphlets, tickets, publications, or subscriptions to publications or brochures upon the representation, expressed or implied, that the proceeds of such sale will be used for a charitable purpose as such term is herein defined. Expressly excluded from the meaning of “charitable funds” is membership in any organization. Charitable funds shall include anything received as a result of a request for donations by a charitable organization, said funds used for the purpose of either sustaining the charitable organization or benefiting others.

Charitable organizations shall mean any organization holding a certificate of exemption from federal income tax or state sales or franchise taxes.

Charitable purpose shall mean philanthropic, religious or other nonprofit objectives, including the benefit of poor, needy, sick, refugee, or handicapped persons; the benefit of any religious or church society, sect, group or order; the benefit of a patriotic or veterans association or organization; the benefit of any fraternal, social or civic organization, or the benefit of any educational institution. The term “charitable purpose” shall not be construed to include the direct benefit of the individual making the solicitation. Nor shall the term be construed to include the benefit of any political group or political organization which is subject to financial disclosure under federal or state law.

Charitable sales shall mean the sale by a charitable organization to the ultimate consumer or user of goods or services whereby the proceeds are intended to be applied to the charitable organization either for the purpose of maintaining the organization or benefiting others provided that at least 40 percent of the gross sales are actually donated to the sponsoring charity.

Commercial handbills shall mean any printed or written matter in the form of a circular, leaflet, pamphlet, paper, or any other printed or otherwise reproduced original or copies of any matter or literature which tends primarily to accomplish the following:

(1) Advertises for sale of any merchandise, product, commodity, or thing; (2) Directs attention to any business or mercantile or commercial establishment, for the purpose of either directly or indirectly promoting the interest of the sales; (3) Directs attention to or advertises any meeting, theatrical performance, exhibition, or event of any kind, for which an admission fee is charged for the purpose of private gain or profit; (4) Is predominantly and essentially an advertisement and is distributed or circulated for advertisement purpose, although it contains reading matter other than advertising matter.

Handbill distributor shall mean any person or business entity distributing commercial or noncommercial handbills within the city. This term shall include all distributions that are made door-to-door and any distributions that are made on or in motor vehicles.

Interstate commerce shall mean the sale of goods that are brought directly from another state to be delivered to the ultimate consumer. Goods that are warehoused or otherwise stored within this state are not considered to be within interstate commerce.

Itinerant vendors shall mean any person or business entity establishing a place of business in the city on a temporary basis. The term shall include without limitation:

(1) All roadside sales locations located in or on rights-of-way; (2) Outdoor sales booths; (3) Set ups; (4) Tailgate sales; (5) Truckload sales and tent sales; (6) All door-to-door sales locations, all sales from “moving vehicles”; (7) Auctions, either private or public; and (8) All indoor sales of a temporary nature not conducted in a retail establishment.

Moving vehicle sales shall mean any sales made from a vehicle that stops as it moves down a road.

Parking lot shall mean any area covered by asphalt, cement or other material designed and suitable for the purpose of parking vehicles and actually used for same or approved by the city as a parking lot.

Retail sales shall mean a sale to the ultimate consumer or user of any food, beverage, goods, merchandise, or services intended or sold for personal, family, or household use, as distinguished from commercial or business use.

Solicit charitable contributions shall mean a request for any charitable funds. A solicitation of charitable funds is complete when the solicitation is communicated to any individual then located within the corporate limits of the city.

Solicitors shall mean any person or business entity conducting a business within the city without a fixed location or place of business. The term shall include all door-to-door sales persons and any agent or representative doing business by calling in person upon potential customers, without appointment, for retail sales.

Temporary shall mean any business transaction in the city for which definite arrangements have not been made for hire, rental or lease of a structure conforming to the codes and ordinances of the city for at least one month.

(Code 1988, § 15-151; Ord. No. 702, § 1(1), 8-8-1988)

Sec. 90-20. – License and application.

(a) Every itinerant vendor, solicitor or handbill distributor shall have a license issued by the city inspections department. However, such requirement shall not be applicable to an auctioneer or associate auctioneer who holds a license under V.T.C.A., Occupations Code ch. 1802 and who is in compliance with such chapter.

(b) An applicant shall apply for a license with the inspections department on a form promulgated by the city, which form shall supply the following information: (1) Name of applicant; (2) Legal name of the business entity, if any; (3) Local phone number; (4) Permanent location, address and phone number; (5) Names of employees; (6) Permanent addresses of employees; (7) Date of birth; (8) Driver’s license number and state; (9) Location of birth for all individuals involved in sales activity; (10) State of incorporation or filing of a partnership or articles of incorporation; (11) Copy of Charter or articles of incorporation and current listing of directors, partners or principles (not required if listed on American or New York Stock Exchange); (12) Sales tax number; (13) Copy of applicant’s sales tax permit, where required; (14) Copy of permits to do business in the state for foreign corporations; (15) If the business is not door-to-door or person-to-person: a. A copy of written permission to locate in the proposed parking lot if private property; or permit, if public property and permission is required; b. A listing of the kind, amount, and character of goods or services to be sold; c. A description and diagram of the location including parking availability, street access, location and amount of space to be utilized and sign to be displayed; d. A description of vehicle for moving vendor. (16) If the action is to be a solicitation of funds, then a description of that purpose will be set out in the application; (17) If applicable, a statement that the goods are in interstate commerce and a statement as to the location of the goods at this time and the last location of the goods; (18) A statement under oath that each individual applicant has read and is familiar with V.T.C.A., Business and Commerce Code ch. 39 (Cancellation of Certain Consumer Transactions); (19) A bond in the sum of not less than $250.00, executed by the itinerant vendor, solicitor, or handbill distributor with two or more good and sufficient sureties satisfactory to the head of the inspections department made payable to the mayor of the city, and his or her successors in office for the use and benefit of any person or persons entitled thereto, and conditioned that the principal and sureties will pay all damages to persons caused by or arising from or growing out of any action of the itinerant vendor, solicitor, or handbill distributor while conducting business in the city. The bond shall remain in full force and effect for the entire duration of the license permit provided herein and for two full years after such license permit expires.

(c) An applicant may seek a license for itself covering all of its employees or agents, but shall supply at least 48 hours prior to sales activities by any individual the following individual information: (1) Employee/agent’s name; (2) Residence address of employee/agent; (3) Date of birth of employee/agent; (4) Driver’s license number of employee/agent; (5) Location of birth for employee/agent. Each applicant shall sign a statement on the application that it recognizes the individual licensed under its license as employees/agents and not as independent contractors, and that it accepts the responsibilities imposed by state law for the acts of its employees/agents. Independent contractors shall be separately licensed and shall meet the requirements of subsection (b) of this section.

(d) An application for a license as an itinerant vendor, solicitor or handbill distributor shall be accompanied by a fee of $25.00 for a sole proprietor or business entity plus $3.00 for each individual engaged in sales activities who will have any contact with the public.

(e) A license shall be issued not later than ten days after the filing of a complete application.

(f) A license may be denied under the following circumstances: (1) When the required information is incomplete or incorrect or shows that a person is not otherwise entitled to conduct business under the plan proposed; (2) If a location plan or diagram: a. Does not locate the activity in an existing parking lot. b. Where there is an open and operating business at the location, utilizes more than five percent of the available parking space, or 16 spaces, whichever is smaller. c. Locates the activity in the parking lot so as to cause a traffic hazard.

(g) Every license shall be displayed where it can be read by the general public either at the place of the business subject to the provisions of this article or visibly shown by the person making door-to-door sales or distributing handbills.

(h) A license issued under this article is not transferable.

(i) A license may be revoked under the following circumstances: (1) For fraud or misrepresentation in the application for the license; (2) For fraud or misrepresentation in the course of conducting the business of vending; (3) For conducting the business of vending contrary to the conditions of the license; or (4) For conducting the business of vending in such a manner as to create a public nuisance or constitute a danger to the public health, safety, or welfare.

(j) Any employee/agent working for an applicant licensed under subsection (c) of this section may be denied the right to solicit under such permit, or such rights may be suspended or terminated, under the same circumstances and procedures which apply to the holder of the license. Revocation or suspension of the holder’s license terminates all employee/agent permits.

(k) An itinerant vendor/solicitor shall comply with the city sign ordinance. (l) The building services division shall notify a permittee (or an employee/agent whose rights thereunder are involved) of the possible suspension or termination of a license by regular mail, addressed to the most recent address in the city’s permit file for the permittee, allowing three days for delivery and setting a hearing on such termination or suspension, not sooner than five days, nor later than eight days from the mailing of the notice. A permittee (or employee/agent) may appeal the suspension, termination, or denial of a permit by the inspections department to the city council. Notice of appeal must be given within ten days of the ruling. The suspension or termination shall not be effective until such final resolution by city council.

(Code 1988, § 15-152; Ord. No. 702, § 1(2), 8-8-1988)

Sec. 90-21. – Duration of licenses.

(a) Itinerant vendors’ licenses shall be valid for one year. (b) Solicitors’ and handbill distributors’ licenses shall be valid for 30 days but may be renewed upon payment of a $10.00 renewal fee. A renewal shall be valid for 12 months. Individual employees’ licenses may be renewed upon payment of a $1.00 renewal fee. Each applicant for renewal must verify permit information as correct and file copies of sales tax returns for the prior license period.

(Code 1988, § 15-153; Ord. No. 702, § 1(3), 8-8-1988)

Sec. 90-22. – Restrictions.

(a) No itinerant vendor may locate for more than three consecutive days or 21 cumulative days per year in an area.

(b) No itinerant vendor may locate in the street right-of-way or highway right-of-way without the written permission of the state highway district engineer or the city engineer having control over such property.

(c) Itinerant vendors/solicitors doing business from a moving vehicle shall not: (1) Stop at a stationary location nor operate in any congested area where his or her operation impedes traffic or where it impedes access to the entrance of any adjacent building or driveway. (2) Do business on the following streets: a. Texas Avenue; b. Highway 21; c. Villa Maria; d. Briarcrest; e. William Joel Bryan Parkway; f. College Avenue; g. Wellborn Road; h. Finfeather. (3) Stop for a period of time longer than ten minutes at any location.

(d) No itinerant vendor, solicitor, or handbill distributor may locate on any private property without written permission to do so. (e) No solicitor or handbill distributor may remain on private property without the permission of the owner or if asked to leave. (f) No person shall distribute, deposit, place, throw, scatter, or cast any commercial handbill upon any premises if requested by anyone not to do so, or if there is place near or at the entrance thereof a sign bearing the words “No Advertisement.” (g) No person shall sell or offer for sale any item upon any premises if requested by anyone not to do so, or if there is placed at or near the entrance thereof a sign bearing the words “No Peddlers or Vendors,” “No Trespassing,” or “No Solicitation.” (h) Solicitors and handbill distributors shall conduct business only between the hours of 8:00 a.m. and 8:00 p.m. (i) Each vendor shall collect all trash or debris accumulating within 15 feet of any vending location and shall deposit such trash or debris in a trash container.

(Code 1988, § 15-154; Ord. No. 702, § 1(4), 8-8-1988)

Sec. 90-23. – Exemptions.

Under this article the following are exempt in whole or in part:

(1) Any organization, group, or individual making a distribution of a noncommercial handbill shall be required to obtain a license but shall not be required to pay an application fee nor present a bond;

(2) Charitable organizations making charitable sales or soliciting charitable contributions for a charitable purpose shall be required to obtain a license but shall not be required to pay an application fee or present a bond for any license;

(3) Any person or other business entity doing business in interstate commerce shall not be required to pay an application fee for any license;

(4) Christmas tree sales are exempted from the location requirement of five percent or within 16 spaces, and are exempt from the time requirement of three consecutive days or 21 cumulative days. Christmas tree sales may be made during the Christmas holiday season, November and December.

(Code 1988, § 15-155; Ord. No. 702, § 1(5), 8-8-1988)

Sec. 90-24. – Violations, enforcement and penalties.

(a) It shall be unlawful for any itinerant vendor, solicitor, or handbill distributor, directly or through an agent or employee, to act without a current, valid license issued under this article or to fail to comply with each and all regulations regarding his or her actions stated in this article.

(b) Each major highway entering the city shall have a sign advising any traveler of the requirement for a license under this article.

(c) It shall be the duty of all peace officers to examine all places of business and persons subject to the provisions of this article to determine if this article has been complied with and to enforce the provision of this article against any person found to be in violation of the same.

(d) A violation of this article shall be punishable by a fine of not less than $25.00 nor more than $500.00.

(Code 1988, § 15-156; Ord. No. 702, § 1(6), 8-8-1988)

Texas Transportation Code (provided by the Bryan police department

Sec. 552.007. SOLICITATION BY PEDESTRIANS. (a) A person may not stand in a roadway to solicit a ride, contribution, employment, or business from an occupant of a vehicle, except that a person may stand in a roadway to solicit a charitable contribution if authorized to do so by the local authority having jurisdiction over the roadway.

(b) A person may not stand on or near a highway to solicit the watching or guarding of a vehicle parked or to be parked on the highway.

(c) In this section, “charitable contribution” means a contribution to an organization defined as charitable by the standards of the United States Internal Revenue Service.